Hello, my name is Jonathan Xianqi Zeng. I’d like to continue my last discussion on the options for a software company to pursue a platform strategy, converting their current product offerings to a platform that enables customers to achieve more values within an integrated toolbox.

The second option is to:

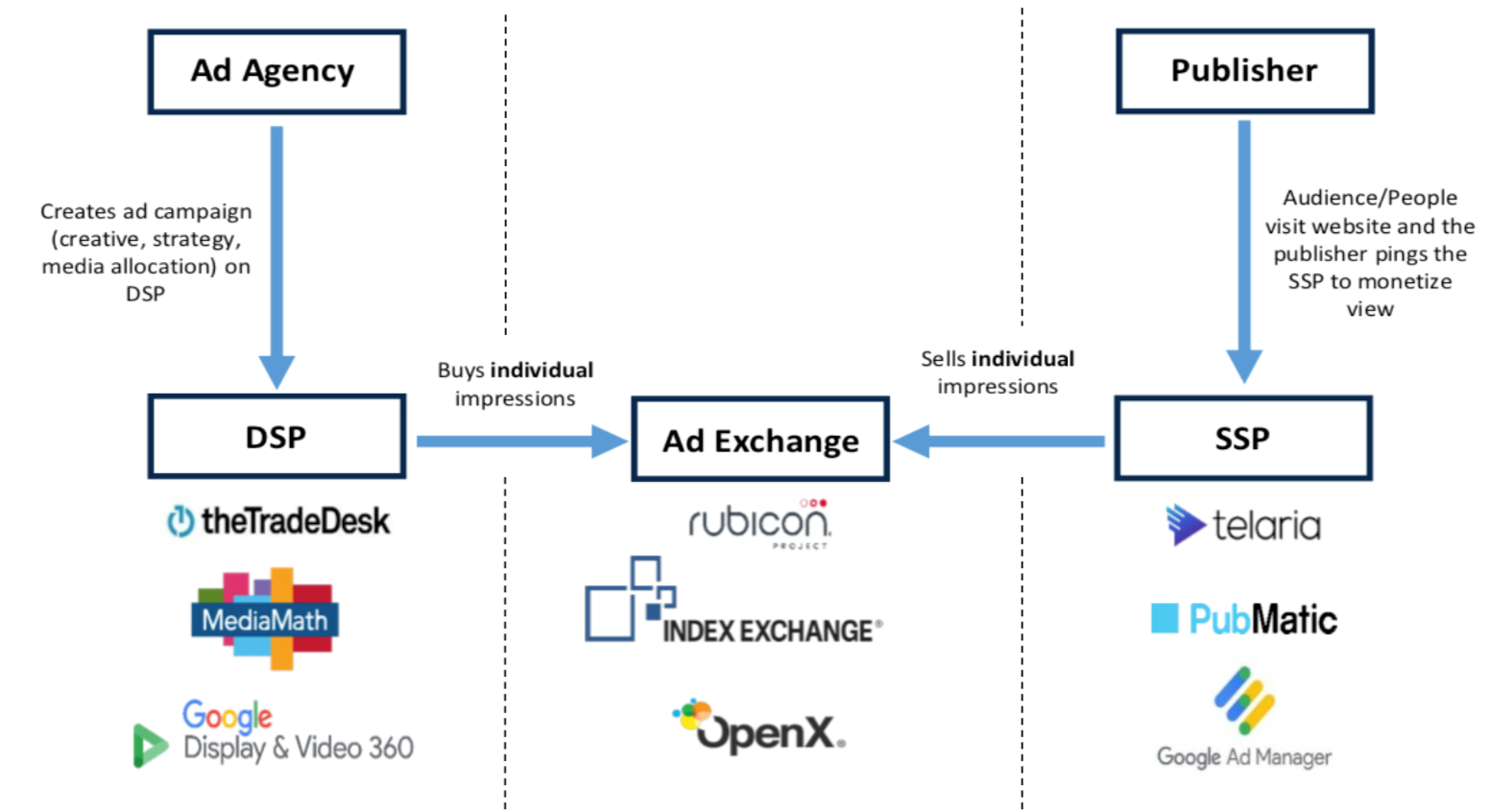

Connect existing customers. In this method, software product provider can try to identify customers’ types and find out ways to connect multiple types of customers. In my business school class, several examples were given: for example, both consumers and lenders are customers of Equifax – on one side, consumers can access Equifax to check their latest credit scores; on the other side, lenders can use Equifax to check the borrowers’ credit scores as well for the purpose of lending. As the market place grows, Equifax was able to connect both sides, and harvest network effects by recommending either side to another. As terrific as the example, I also find other software companies that could use this method to create a platform. Specifically in the advertising space, digital advertising companies can really build an ecosystem to connect publishers (those who provide advertising inventories including but not limited to newspaper, online media, connect TV etc.) with advertisers (advertising agencies who represent brands such as P&G, Audi etc.). There are several ways a software product that traditionally provides advertisers with online real-time bidding functionalities to convert to a platform. Specifically I am thinking about companies such as Adobe, The Trade Desk, Rubicon Project. These are traditionally either represent only Ad Agency or Publisher but not both sides. In a platform strategy, one could imagine a company such as The Trade Desk creates an advertising platform where it not only bids ads for Ad Agencies, but also recommends the other way around, for publishers to look for brands that might be interested in their provided inventories, and therefore creating more efficient linking between advertisers and publishers. Following is a diagram showcasing the current world (courtesy from Stephens).

That said, there are two main concerns in this strategy:

- While product providers could add additional revenues from the other way of the flow, willingness-to-pay by ad agencies in this platform might reduce. This could happen due to a fear of software provider’s possibly impaired objectivity. In a product strategy world, companies such as The Trade Desk essentially acts as the broker for Ad agencies, and therefore aligning its interest tightly with Ad agencies. However, in the new platform strategy, as a platform provider, The Trade Desk’s interest would be to maximize the total profits from the platform as a whole. Note that this issue could be a drawback of creating a platform in general: increased revenue from new sources of business may not make up lost willingness-to-pay from old clients.

- Strategy could impose huge threat to incumbents, and create a war that could never be won by a niche player. In executing a platform strategy, it seems clear that resources (could mean anything from cash, to talents, to customer base etc.) highly correlate with the success rate of the strategy’s execution. If a player that traditionally focuses on a small set of customers (ad agencies) decide to pursue platform strategy and expand to wider client base (publishers), it poses a threat to large incumbents such as Google Ads business, and could incur a retaliation by Google. It will be disastrous to The Trade Desk if Google starts to prioritize this line of business and deploy significant amount of resources to drive The Trade Desk out of business.